With more choice than anyone could ever watch in a single lifetime, it’s easy to think there’s never been a better time to be a TV viewer. The reality, however, is that the explosion of choice has made it increasingly difficult for people to find something they’re interested in. While this challenge is prevalent across all TV options, it’s particularly relevant in the free ad-supported television (FAST) universe, which continues to gain traction with audiences suffering from subscription fatigue.

Exciting color!

In addition to competing with a wide range of platforms and channels, FAST channels compete with the hundreds of other channels that are often included in a single service. And that challenge gets magnified significantly when the programming lacks the information that audiences need to determine if they’re interested in it. And somewhat surprisingly, this is a common shortcoming.

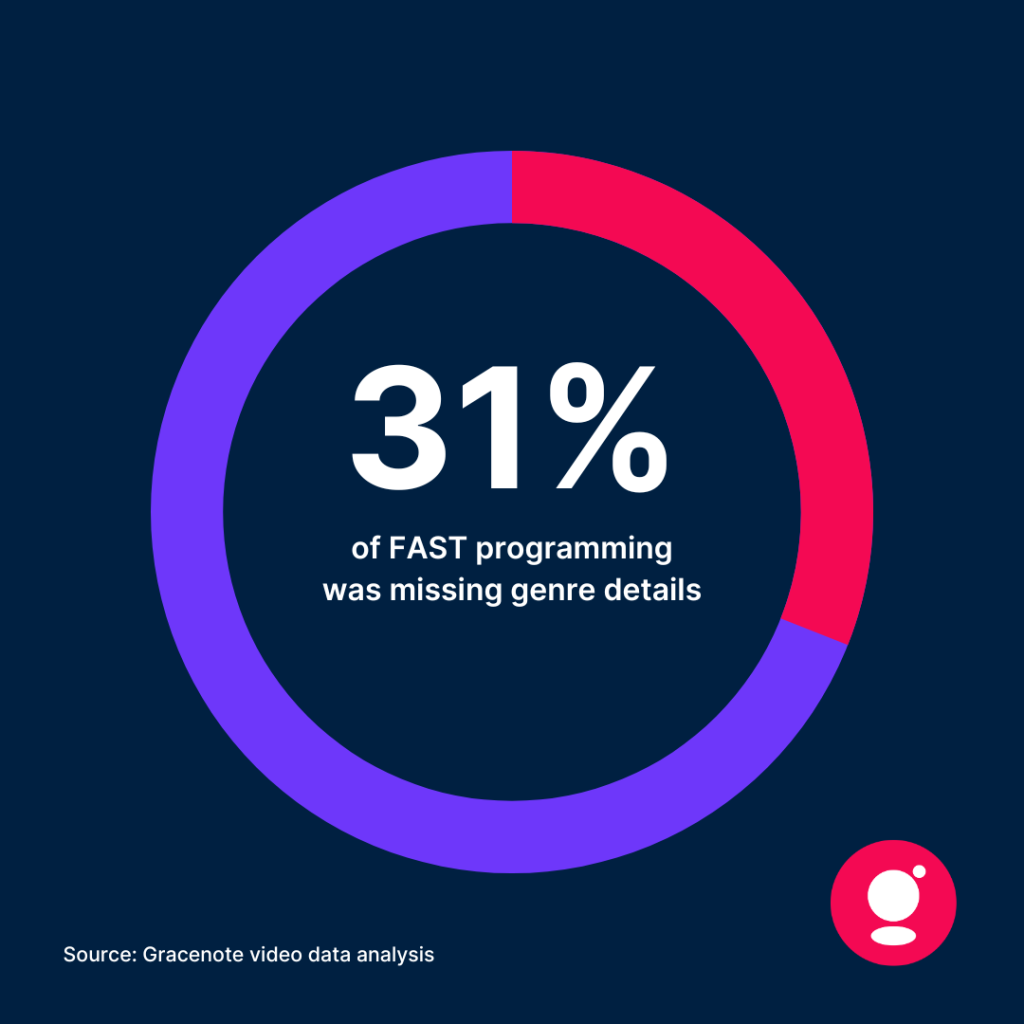

A recent analysis, for example, found that almost one-third of the programs in Gracenote’s FAST database lacked genre details when they were submitted for metadata enrichment. The implications for programming here are clear.

At a very high level:

- A service/platform can’t categorize it

- Viewers won’t know if they’d be interested in it

- Brands won’t know if they want to advertise against it

It’s doubtful that programming would make its way to a service without critical information like genre, but any platform-driven assignment would lack the uniformity to ensure interoperability across the broader streaming universe. It’s also possible that assigned defaults could be inaccurate.

The good news in this scenario is that the creators submitted their programming to Gracenote for metadata normalization and enrichment. The downside is that FAST is still catching up with metadata–even with respect to the basics, like genre, production country, production company, original air date, rating and imagery.

So what’s the big deal?

To understand the importance of metadata is to understand the state of streaming. Content and service choice has become overwhelming, and audiences are looking for ways to identify content they’re interested in. A recent LG Ad Solutions survey found, for example, that 56% of audiences now prefer to watch streaming video than traditional TV, but they spend 12 minutes looking for something to watch. And a full 70% prefer ad-supported content, which is right in FAST’s sweet spot.

The appeal of FAST isn’t lost on audiences. In the U.S., TV audiences have more than doubled their FAST viewing over the past year: In February of last year, Pluto TV and the Roku Channel accounted for 1.7% of total TV usage. A year later, those services plus Tubi accounted for 3.7%1.

Sources

- Nielsen’s The Gauge, February 2024.